In a move that has stunned financial analysts and sent shockwaves through global markets, the price of gold has executed a breathtaking rally, smashing through the $5,500 per ounce barrier. This unprecedented surge, a gain of over 15% in a single week, is being directly attributed to a dramatic escalation in geopolitical tensions, spearheaded by renewed and fierce sabre-rattling from former U.S. President Donald Trump regarding Iran.

Market watchers are describing the current climate as a “perfect storm” for the precious metal, combining raw geopolitical fear with deep-seated financial anxieties.

The Spark: Trump’s Bellicose Rhetoric

The immediate catalyst for the spike was a series of comments and social media posts from Trump, the presumptive Republican nominee for the 2024 presidential election. In rallies and interviews, he has sharply criticized the current administration’s approach to Iran, advocating for a far more aggressive stance. He suggested a potential “massive” response to any provocation and labeled the 2015 nuclear deal as “the worst deal ever,” hinting at a possible push for regime change if re-elected.

“Trump’s rhetoric is a game-changer,” explained Maya Chen, Chief Commodities Strategist at Aurelius Capital. “Markets can price in existing policy. They can’t price in the uncertainty of a return to a maximum-pressure campaign that brought us to the brink of conflict in 2020. Traders are buying gold as insurance against a potential military confrontation that could disrupt oil supplies and trigger a regional war.”

The Fuel: A Tinderbox of Underlying Fears

While Trump’s words provided the spark, the gold market was primed to explode due to several underlying factors:

- Central Bank Buying Spree: Nations like China, India, and Russia have been aggressively diversifying their reserves away from the U.S. dollar for months, creating a sustained floor of demand for bullion.

- Persistent Inflation: Despite cooling in some regions, inflation remains stubbornly above central bank targets in many major economies, eroding the value of fiat currencies and reinforcing gold’s role as a store of value.

- Mounting Debt Concerns: Soaring global sovereign debt levels are raising long-term questions about fiscal stability, making an asset with no counterparty risk increasingly attractive.

- Dollar Weakness: Recent hints of a less hawkish Federal Reserve have softened the U.S. dollar, making dollar-priced gold cheaper for international buyers.

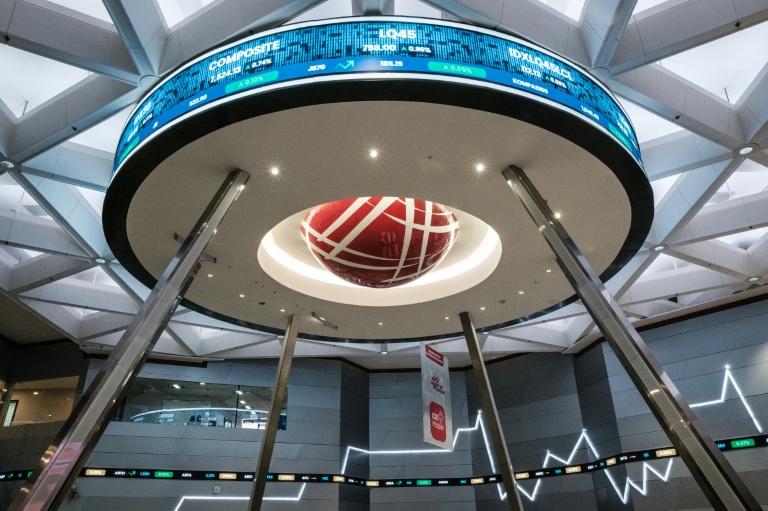

Market Reaction and Fallout

The flight to safety has been brutal and swift.

- Equities Tumble: Global stock markets, particularly in Europe and Asia, have sold off sharply. The S&P 500 and NASDAQ are down over 5% this week.

- Oil on the Boil: Brent crude has surged past $110 a barrel on fears of a supply choke from the Strait of Hormuz, further stoking inflationary fears.

- Bond Yields See-Saw: A chaotic move into U.S. Treasuries (a traditional safe haven) was tempered by fears that conflict-driven inflation could force the Fed to keep rates higher for longer.

- Miners & ETFs Skyrocket: Shares of gold mining companies and funds tracking the precious metal (like GLD) have seen record inflows and double-digit gains.

“A New Paradigm for Precious Metals”

“This isn’t just a spike; it feels like a fundamental re-rating,” said James Harrington, a veteran metals trader in London. “$5,500 was unthinkable six months ago. We’re now hearing whispers of $6,000 if there’s a single kinetic event. The market is pricing in a world where geopolitical risk is the dominant macroeconomic driver, not interest rates or GDP growth.”

What Comes Next?

Analysts warn of extreme volatility ahead. The gold price is now hypersensitive to any headline from the U.S. campaign trail or the Middle East. A de-escalation in rhetoric could trigger a sharp, corrective sell-off. Conversely, any actual military incident could propel prices into uncharted territory.

The breach of the $5,500 ceiling is more than a financial milestone; it is a stark barometer of global anxiety. As the U.S. election approaches and the situation in the Middle East remains fraught, the world’s oldest safe haven is sending a clear, metallic signal that investors are bracing for stormy times ahead.